Unlock the Secrets of Financial Volatility with Stochastic Volatility Modeling

<meta name="viewport" content="width=device-width, initial-scale=1.0"> <meta name="keywords" content="Stochastic volatility, financial volatility forecasting, volatility models, ARCH, GARCH, SV models, risk management, investment strategies"> <link rel="stylesheet" href="style.css"> <h2> : Embracing the Complexity of Financial Markets </h2> <p> The financial markets are an intricate web of interconnected entities, where volatility reigns supreme. Understanding and modeling this volatility is crucial for investors and financial professionals alike, enabling them to navigate the ever-changing market landscape. Stochastic volatility modeling emerges as a powerful tool in this endeavor, offering invaluable insights into the dynamic nature of financial volatility. </p> <h2> Uncovering the Essence of Stochastic Volatility Modeling </h2> <p> Stochastic volatility modeling introduces a groundbreaking approach to volatility analysis. Unlike traditional models that assume constant volatility, stochastic volatility models recognize the inherent time-varying behavior of volatility. This advanced approach provides a more realistic representation of financial markets, capturing the periods of high and low volatility that characterize real-world scenarios. </p> <h3> Key Concepts and Methodologies </h3> <p> The world of stochastic volatility modeling is built upon a solid foundation of statistical concepts and methodologies. This section delves into the essential building blocks of stochastic volatility modeling: </p> <ul> <li> **ARCH and GARCH Models:** Autoregressive Conditional Heteroscedasticity (ARCH) and Generalized ARCH (GARCH) models serve as the cornerstone of stochastic volatility modeling. These models capture the persistence in volatility, allowing for accurate forecasting of future volatility levels. </li> <li> **SV Models:** Stochastic volatility (SV) models extend the capabilities of ARCH and GARCH models by introducing a latent volatility process. This process drives the volatility dynamics, providing a more nuanced understanding of volatility fluctuations. </li> <li> **Estimation Techniques:** Maximum likelihood and Bayesian inference are the primary methods used for estimating the parameters of stochastic volatility models. These techniques leverage historical data to infer the underlying volatility dynamics. </li> </ul> <h2> Practical Applications in Risk Management and Investment Strategies </h2> <p> Stochastic volatility modeling transcends theoretical concepts and finds practical applications in the realm of risk management and investment strategies. By incorporating stochastic volatility models into their frameworks, professionals gain a competitive edge in the financial marketplace: </p> <h3> Risk Management </h3> <p> Stochastic volatility models are indispensable for risk managers seeking to quantify and mitigate risks associated with financial assets. These models provide accurate estimates of volatility, enabling risk managers to make informed decisions regarding risk exposure and portfolio diversification. </p> <h3> Investment Strategies </h3> <p> Investment professionals leverage stochastic volatility models to enhance their investment strategies. By forecasting volatility levels, investors can make strategic decisions regarding asset allocation, hedging strategies, and market timing. This knowledge empowers them to navigate market fluctuations and maximize returns. </p> <h2> Delving into Stochastic Volatility Modeling with Chapman and Hall/CRC's Invaluable Guide </h2> <p> Enter the comprehensive guide to stochastic volatility modeling from Chapman and Hall/CRC: a masterpiece crafted by leading experts in the field. This book offers an in-depth exploration of the subject, covering both theoretical foundations and practical applications. </p> <h3> Unveiling the Content Riches </h3> <p> Within the pages of this invaluable guide, readers will embark on an enlightening journey through the intricacies of stochastic volatility modeling. The book delves into: </p> <ul> <li>Fundamental concepts and methodologies</li> <li>Advanced topics, including multivariate stochastic volatility models</li> <li>Real-world applications in risk management and investment strategies</li> <li>Case studies and examples for practical implementation</li> </ul> <h3> Why Choose Chapman and Hall/CRC's Guide? </h3> <p> This guide stands out as an indispensable resource for anyone seeking a comprehensive understanding of stochastic volatility modeling. Its strengths include: </p> <ul> <li>Expert authorship by renowned practitioners</li> <li>Comprehensive coverage of both theory and applications</li> <li>Real-world examples and case studies</li> <li>Accessible language and clear explanations</li> <li>Up-to-date insights into the latest developments</li> </ul> <h2> Embrace the Power of Stochastic Volatility Modeling Today </h2> <p> Invest in your financial knowledge and elevate your investment strategies with Chapman and Hall/CRC's guide to stochastic volatility modeling. Unlock the secrets of financial volatility and gain the competitive edge necessary to navigate the ever-changing financial markets. </p> <p> Free Download your copy today and embark on a transformative journey into the world of stochastic volatility modeling. </p> <p> <img class="YQLzN _0J49M _0EB9Q Qa8V0" alt="Cover Of Stochastic Volatility Modeling Book Stochastic Volatility Modeling (Chapman And Hall/CRC Financial Mathematics Series)" width="1360" height="900" src="https://tse2.mm.bing.net/th?q=Cover-Of-Stochastic-Volatility-Modeling-Book&w=672&c=7&rs=1&p=t0&dpr=1&pid=1.7&mkt=en-US&adlt=on"> </p> <p> <a href="https://www.routledge.com/Stochastic-Volatility-Modeling/1st-Edition/p/book/9781138315887"> Free Download Now </p> </article>4.7 out of 5

| Language | : | English |

| File size | : | 114280 KB |

| Screen Reader | : | Supported |

| Print length | : | 522 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Steve Salisbury

Steve Salisbury Maria Elena Reyes Schafer

Maria Elena Reyes Schafer Lindy Everbridge

Lindy Everbridge Lynne Sharon Schwartz

Lynne Sharon Schwartz Margaret D Jacobs

Margaret D Jacobs Omar Montes

Omar Montes Linda Melvern

Linda Melvern Lichelle Slater

Lichelle Slater Raven Kennedy

Raven Kennedy Linda Forbringer

Linda Forbringer Marion Zimmer Bradley

Marion Zimmer Bradley Lisa Roe

Lisa Roe Millie Huff Coleman

Millie Huff Coleman Lisa Bird Wilson

Lisa Bird Wilson Lawrence Block

Lawrence Block Leigh Russell

Leigh Russell Lee Benson

Lee Benson Linda Evans Shepherd

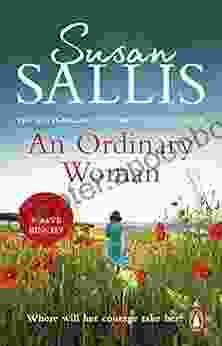

Linda Evans Shepherd Susan Sallis

Susan Sallis Lisa Frase

Lisa Frase

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Robert Louis StevensonPlay Solo Flamenco Guitar With Juan Martin Vol. 1: The Ultimate Guide to...

Robert Louis StevensonPlay Solo Flamenco Guitar With Juan Martin Vol. 1: The Ultimate Guide to...

John Dos PassosEmpowering Educators: Unlocking the Secrets to Teaching Reading in Three...

John Dos PassosEmpowering Educators: Unlocking the Secrets to Teaching Reading in Three...

Federico García LorcaEscape into Enchantment with The Four Kingdoms Box Set: Three Fairytale...

Federico García LorcaEscape into Enchantment with The Four Kingdoms Box Set: Three Fairytale... Branden SimmonsFollow ·6.8k

Branden SimmonsFollow ·6.8k Rod WardFollow ·18.2k

Rod WardFollow ·18.2k Albert ReedFollow ·10.6k

Albert ReedFollow ·10.6k Jorge AmadoFollow ·19.8k

Jorge AmadoFollow ·19.8k John GrishamFollow ·10.9k

John GrishamFollow ·10.9k Robbie CarterFollow ·9.1k

Robbie CarterFollow ·9.1k Jaime MitchellFollow ·9.7k

Jaime MitchellFollow ·9.7k Aron CoxFollow ·11.6k

Aron CoxFollow ·11.6k

W.H. Auden

W.H. AudenTerrorist Events Worldwide 2024: A Comprehensive Guide to...

Terrorism is a global threat that affects...

Carson Blair

Carson BlairBeautifully Uplifting And Enchanting Novel Set In The...

Set in the beautiful West Country, this...

Jeffrey Cox

Jeffrey CoxAn Utterly Captivating and Uplifting Story of One Woman's...

Immerse yourself in an extraordinary...

Greg Foster

Greg FosterEngaging the Issues Through the Politics of Compassion

: The Power of...

4.7 out of 5

| Language | : | English |

| File size | : | 114280 KB |

| Screen Reader | : | Supported |

| Print length | : | 522 pages |